I’ve written about taxes gone wrong before, but it wasn’t until one of my longtime readers DMd me to suggest a post on taxes that I realized I’d never broken it down in the newsletter. I’ve fielded many questions from friends who sometimes freelance or who were forced to freelance or who are now full-time freelancing about the very basics—not because I’m an ace on the subject, but because I’m probably the one single head of household who freelances full-time that they know. I might as well write a very brief primer for you lovely folks. It’ll save me some time hehehe. I can copy+ paste this link for all eternity!

First things first: I AM NOT AN EXPERT, I REPEAT, I AM NOT AN EXPERT. If you take away anything from this post it’s that you should definitely hire an accountant to help you with your freelance taxes. This is only meant as an overview, so you have some idea of what the hell you’re talking about when you do ring up that accountant that is going to help you. If you only use my advice and later get audited or screwed over by Uncle Sam, that is entirely on you. Capiche? Sweet!

How do I even know if I have to report my freelance income on my tax return?

Glad you asked! Here are the most common situations that will require reporting your freelance income to the feds:

If you make more than $400 on freelance income, you have to report it.

If a company, client or organization pays you more than $600 for a project, you have to report it and they have to send you a 1099-NEC form.

If you make more than $600 on certain platforms like Etsy or Stripe, they have to report it and they have to send you a 1099-K form.

There are a bunch of other 1099 forms, but they don’t all relate to freelancing so I’m not gonna touch those. You might get a 1099-MISC if you get money from things like royalties.

So just to be clear: None of my clients have taken money out in advance to cover my taxes, like when you have a full-time job?

NOPE! I’m sure there’s some obscure exception where this might be the case but, by and large, if you’re receiving a 1099 then the company has not taken out any taxes for you. All that form reports is how much they paid you. You are in charge of paying all your taxes to the government. That means freelancers get taxed twice—as en employer (cause you are the boss of yourself) and as an employee (cause you work for yourself). Yes, we pay a shit ton in taxes that are currently being used for what? Bombs, probably, given that the Trump administration is dismantling everything. But I digress.

It’s recommended that you set aside 30% of your income for taxes. I put away 30% of every invoice I send into a high-yield savings account so at least I get some benefit from the massive tax burden I carry on my shoulders.

Is it true that you have to file quarterly taxes???? What in the ever Kafkian-hell is this?

It’s true! And while it’s a pain in the ass to deal with taxes every three months or so, I’ve come around to its virtues. Quarterly taxes are really an estimated tax, emphasis on the estimate. In other words, you are paying toward you overall annual tax burden. I’m sure there are nefarious government reasons to do it quarterly but, for me, it’s a good way to avoid a massive bulk payment come April 15.

The deadlines for quarterly taxes are roughly on the 15th of April, June, September, and January (for the last quarter of the prior year). If the 15th lands on a Saturday or Sunday, it might shift by a couple of days.

How do you know what amount to pay each quarter? There are different ways of tackling this. My preferred way is asking my accountant to estimate it for me. I send her a spreadsheet where I’ve tracked all my income for that quarter and she comes back with a number. Some accountants give you estimates for all the quarters of the following year after you’ve filed your annual return, using your income from the previous year as a rough estimate of what you might make this year. You can also do this on your own: see what you paid in taxes last year and divide it by four. The reason I ask my accountant to do quarterly calculations, even though it is more cumbersome, is because my income has fluctuated so wildly from year to year, I don’t consider past performance as indicative of anything LOL.

It sounds like you have to keep track of so damn much.

You do! That’s why my income/expenses spreadsheet rules my life.

What about deductions?

Ahhhh, deductions! The one balm against the hell that is freelance tax season. You can deduct SO MUCH if you justify it as a business expense. Software. Pens. Dinners with clients. Travel, if you write about it later. Conferences. Coffee. Part of your rent if you work from home. The list is very long and comprehensive. This is when I remind you once again to hire an accountant so they can give you all the info on what you can deduct.

Oh my god, stop it with “get an accountant!”

I won’t! Tax law also differs by state and, sometimes, city. One of the reasons I considered moving to Texas for several years was because they don’t have state income taxes. The reason I didn’t was because they DON’T have much when it comes to social services, which is how I ended up in New York. Despite all its expensive faults, the state gives you public transportation and Obamacare subsidies.

An accountant can also tell you whether it’s worth filing as a sole proprietor, or worth setting up an LLC or S-Corp for your freelance services. These too differ by state. Fun stuff!

Should we all become CPAs?

(Deep sigh.) You have no idea how much I dream of becoming a CPA and having that be my day job.

Any other tip?

If you file online, save your quarterly tax payments as PDFs. Receipts in case the feds make some dumbass mistake and accuse you of tax evasion.

Homework

Do your taxes. Hehehe I feel the side eye already. If taxes feel overwhelming right now, at least do one thing: list all the clients you’ve worked with and see if you’ve received 1099s from all of them. If not, now is the time to reach out and inquire about their whereabouts.

Money Lesson

I always feel like I’m catching up when it comes to making my money work for me, instead of against me, so this might sound soo soo painfully obvious but: Have you heard of high-yield savings accounts? Cause I had not until maybe about 5 years ago. My financial life would be very different right now if I had learned about it ten years ago!

The magic of high-yield savings accounts is that their rate of return is over 4% while a regular savings account will be less than 1%. To give you an idea, I have somewhere between $5,000-$6,000 in my one high-yield savings account right now and I just got about $15 deposited in paid interest. Poof! Like magic. Just for having money sitting there. In my ho-hum savings account where I have a similar amount, I got $0.14. The difference is massive. If you don’t have one yet, research your options!

Progress Report

February was another busy month. Though a lot of my bigger freelance projects wined down, I led a bunch of workshops and panels, including two at StoryStudio’s Pub Crawl. I was rejected by Poetry Online and never got a response for the one pitch I sent last month, but at this point I don’t sweat those Nos. In fact, I’m relieved when I get them because I can keep shit moving, sending it back out in the hopes that the yes will come. I submitted more poetry and my ceviche essay to a few other pubs, applied for an intensive workshop, and sent two different pitches. On the business-y front, I’m very close to signing a contract for a new project with an old client. Do I fear the hammer of DOGE smashing my steadiest gig into smithereens? Yes. But until then, I am billing those hours and am grateful that other clients keep sending me work.

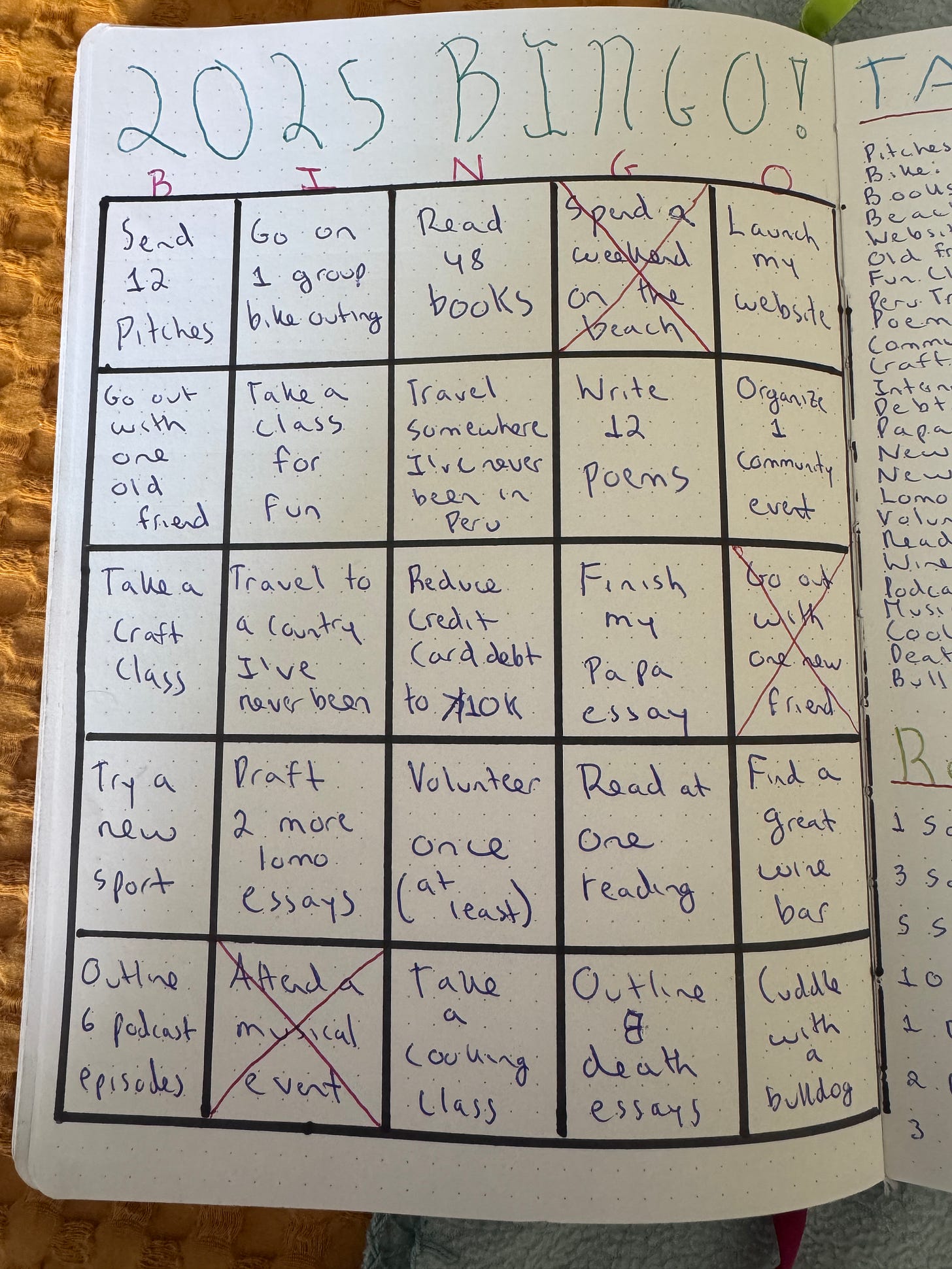

Some of you may remember that I made a bingo card for the year, instead of standard resolutions. I’ve made progress in that area too!

I spent a weekend on the beach with my family earlier in January, which was as deliciously relaxing as I had hoped. Last week, I went to the brilliant restaurant Awa with one of the very cool ladies I’ve met through an all-women expat group. (Still gathering intel on the expat community in Lima, but let’s say that I’ve had more luck with all-women groups than co-ed ones lol, wonder why, hmmmmm).) Finally, I went with my youngest brother to a food and music festival where we jammed to Los Mirlos, the legendary Amazonian psychodelic cumbia band that is going to take Coachella by storm. Here’s a snippet of their set:

I promised myself treats after I crossed off one square and then another after crossing off three squares. I bought myself a plant and a puzzle, respectively. I know, everything I crossed off is also a treat lol. I am making headway into some of the writing goals but those are going to take longer to accomplish.

Subscriber Benefits

Did you miss my first ever mini-salon with Sarah Kokernot of Your Wild and Radiant Mind on harnessing the intuitive and practical in the creative process? You can watch a recording here! Our next mini-salon is on Thursday, March 13 at 12pm CT/1pm ET and the topic is rejection. Paid subscribers have free access to the salon. They can also submit questions ahead of time and will have access to the recording. If you are a free subscriber, the mini-salon is offered as a pay-what-you-can event with $15 as the suggested fee. You can sign up here.

Join me every Monday in March at 6:30 pm ET/5:30 pm CT for the Cranky Guide Writing “Hour”, a forty-minute virtual write-in. You can find more info here.

Shameless Self-Promotion

If you’re going to AWP, you are warmly invited to the nonfiction reading I’ll be participating in on Friday, March 28 at 3:20 pm. Here is the description:

Authors & Actresses: Writing for the Stage & the Page

Memoirs and personal essays require many of the same ingredients as live theater: voice, energy, trust, discipline. In this reading, five writers use the theater as a way to investigate themselves and the world around them through: the politics and Catholic schools of Latin America, a newly articulating disability, the highs and lows of motherhood, the joys and challenges of working as a Black artist, and living apart from a partner while pursuing an artistic career.

If you’re struggling with the artist statement, I can help! My On-Demand class, Navigating the Artist Statement, is available for purchase at StoryStudio. Watch at your own time, at your own pace, and send those babies out!

Every week, I look at Five Calls, pick the issue that is most making me scream into the void, and use their app to call my reps. I know it sounds futile but I want there to be a record of me (and anyone else who supports democracy) saying, “I DO NOT SUPPORT THIS, SIR/MA’AM”. This week, I thin I’m going to tell my reps that I want to see Al Green’s energy from all of them over Medicaid.

Now that I’ve reached 1k subscribers, I would love to get a few more paid subscribers so I can have that damn check next to my name. Can I tempt you with an upgrade??? A paid subscription, includes:

Samples of my pitches & rates, applications, and spreadsheets & templates

Access to the full archive (free posts go behind a paywall after a year)

Access to all mini-salons for free and the ability to send us a question beforehand.

If you ever want to peruse all the books I recommend in the newsletter, head over to my Bookshop bookstore!

Me admitting that I actually need to follow this advice 😒🫡

Taxes are truly the worst, and are the worst part of owning our business. Have you tried using Quickbooks online to sync your freelance spending and income? The simple plan is something like $17 a month and might save you some spreadsheet headache and your accountant can have access to it.